UX UI Design

The challenge:

As a homeowner is often difficult to keep up with the information you need to manage your mortgage. Financial jargon and scattered articles don't make it easy. On the flipside, mortgage providers find it hard to keep important information about their customers.

TEAM & ROLE

I worked in a team of 2 as Product Designer with a Product Owner for 12 months

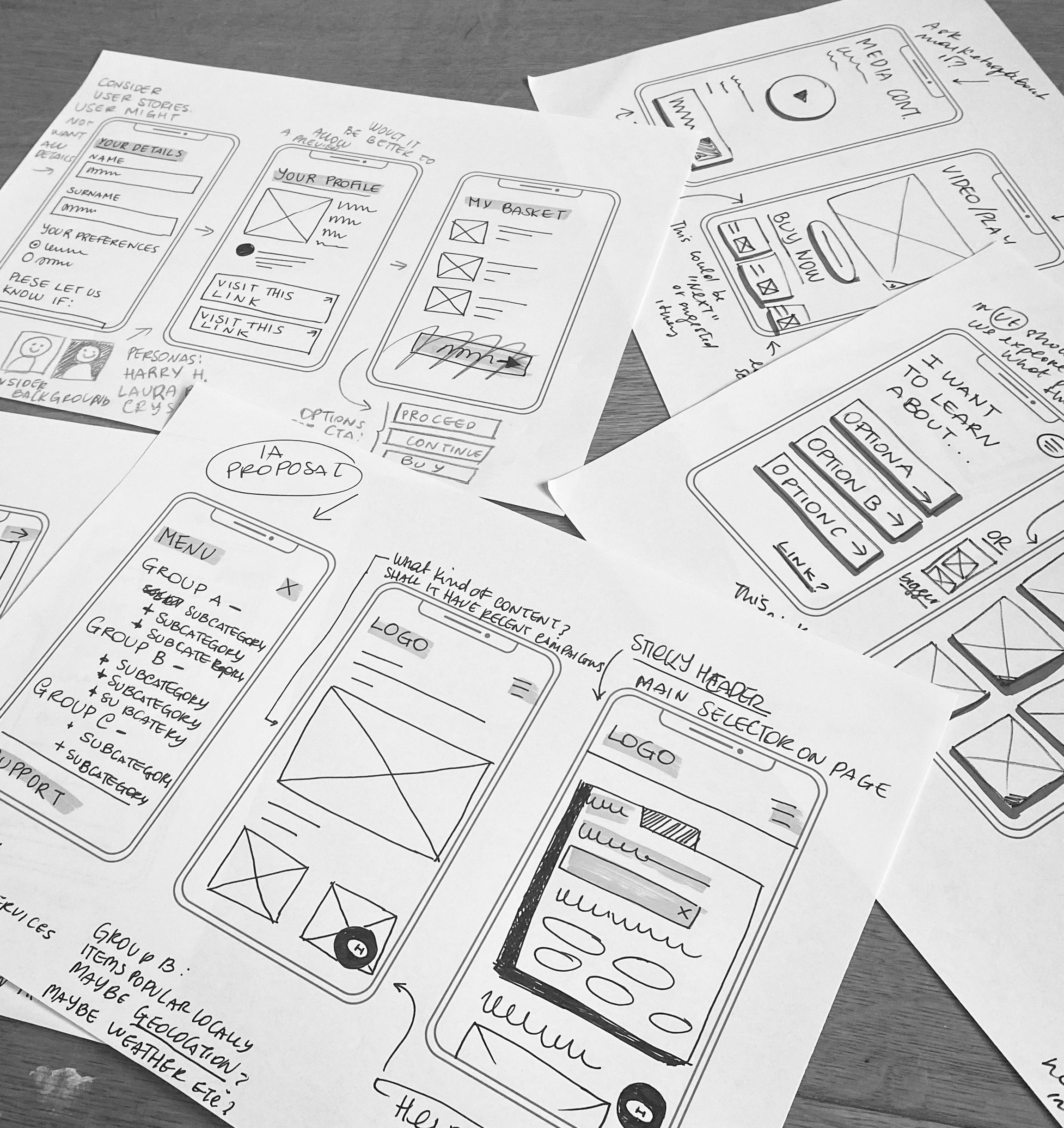

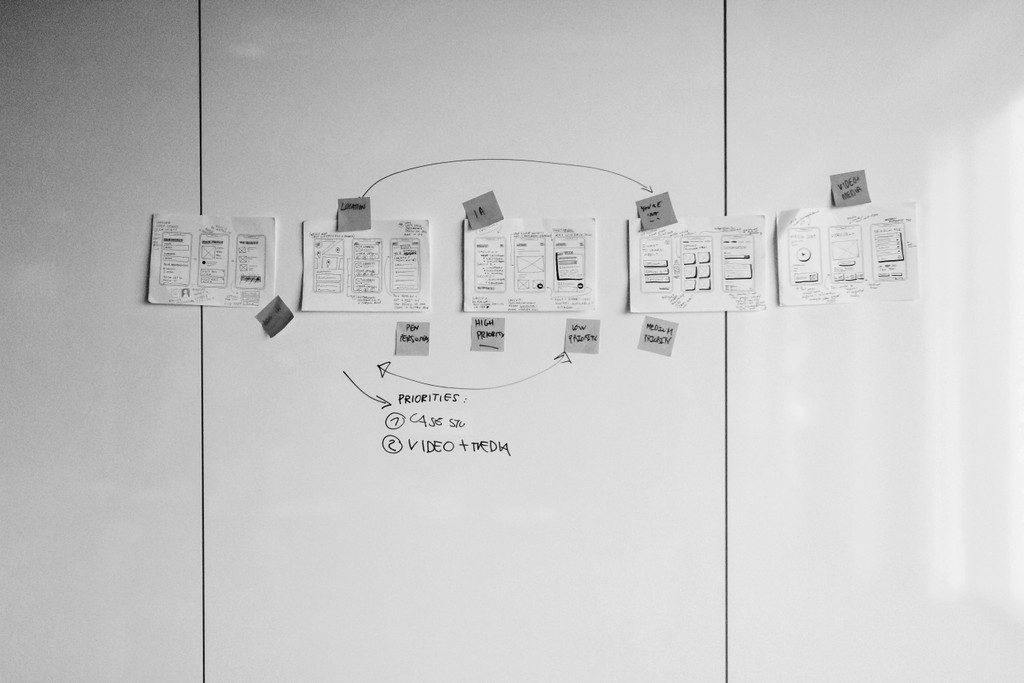

WHAT I DID

Gathering requirements, sketching wireframes, implementing design system, creating UI and high fidelity prototypes, usability testing.

WHAT I DELIVERED

Wireframes, Design system, UI, asset and documentation to guide software engineers shipping Eligible products

PROJECT OUTCOME

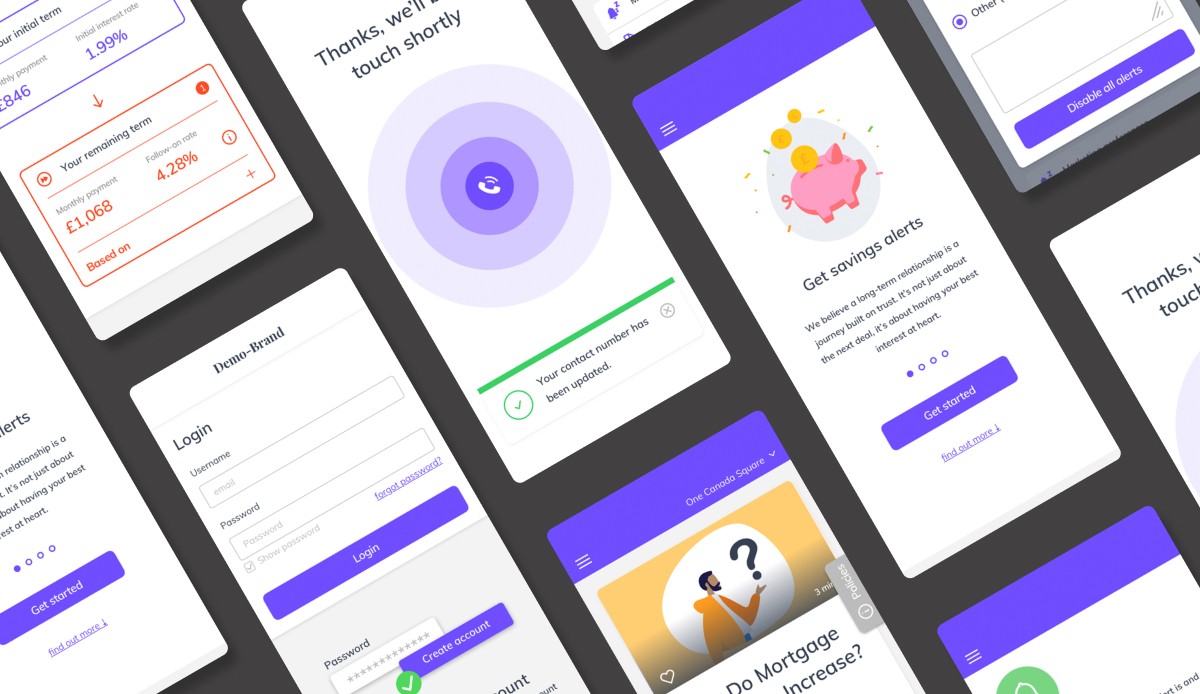

Data visualisation tools for Mortgage providers and ad-hoc journeys for Eligible partners. An easy to navigate library of tailored content for mortgage owners

Defining the key information for mortgage owners: "Your current situation" page

We automated the process to notify home owners when their current mortgage product is about to expire and they should switch to a new product.

This process was previously handled by lenders contacting costumers via phone, which often generated chaos and confusion.

I created a low-friction user flow based on emails to alert the user about their expiration and direct them to their mortgage information page.

This page, as the rest of Eligible's product, is designed to be white labelled and adaptable to any brand in order for the users to perceive the experience as native to their lender.

When users are correctly informed about their mortgage they are able to make better decisions and more willing to switch to a new product. Additional educational content is also available on the page to help users find information they are most likely to seek at this stage.